Services

Income Tax Return

Income Tax e-Filing Made Simple with Legit Filings

Filing your Income Tax Return (ITR) is a key financial responsibility for every Indian taxpayer. It not only ensures compliance with tax laws but also enables you to claim refunds and avoid penalties. Whether you are salaried, self-employed, a business owner, or earning from investments, Legit Filings makes your income tax e-filing process smooth, accurate, and stress-free.

Why File Your ITR?

- Legal compliance under the Income Tax Act

- Claim tax refunds for excess TDS paid

- Required for visa processing, loans, and financial proof

- Avoid penalties and legal issues

Who Needs to File an ITR?

| Category | Income Threshold/Condition |

|---|---|

| Salaried Individuals | Income above basic exemption limit |

| Self-Employed Professionals | Income above threshold (claim expenses) |

| Business Owners | Mandatory, even in case of loss |

| Company Directors/LLP Partners | Compulsory to file ITR |

| Income from Capital Gains/Dividends/Interest | Mandatory to disclose and pay applicable taxes |

| NRIs and RNORs | Income arising in India or foreign income/assets disclosure |

| High-Value Transactions | Deposits, foreign travel, or electricity bills exceeding limits |

| Claiming Refunds | If excess tax paid via TDS/advance tax |

| Charitable/Religious Trusts | Required to maintain transparency |

Tax Regimes & Slabs

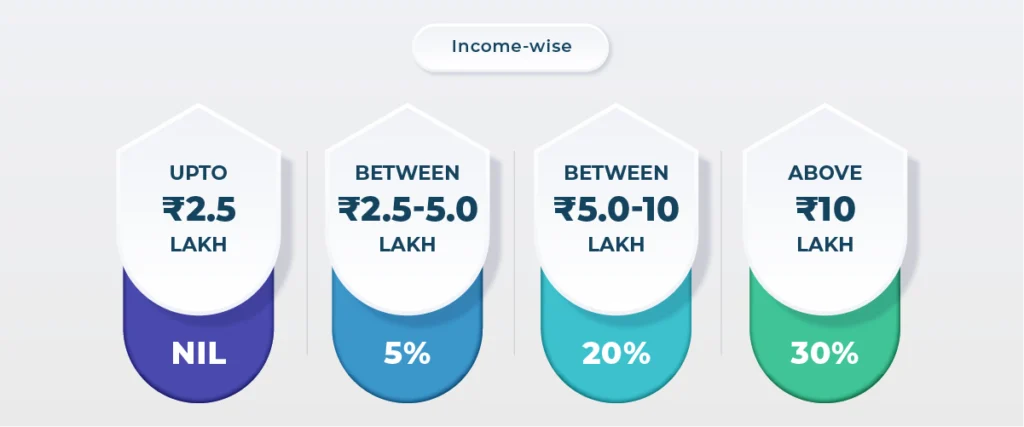

Old Tax Regime

| Age Group | Exemption Limit |

|---|---|

| Below 60 | Rs. 2.5 lakh |

| 60 - 80 years | Rs. 3 lakh |

| 80+ years | Rs. 5 lakh |

| Income Range | Tax Rate |

|---|---|

| Up to Rs. 2.5 lakh | Nil |

| Rs. 2.5 - 5 lakh | 5% |

| Rs. 5 - 10 lakh | 20% |

| Above Rs. 10 lakh | 30% |

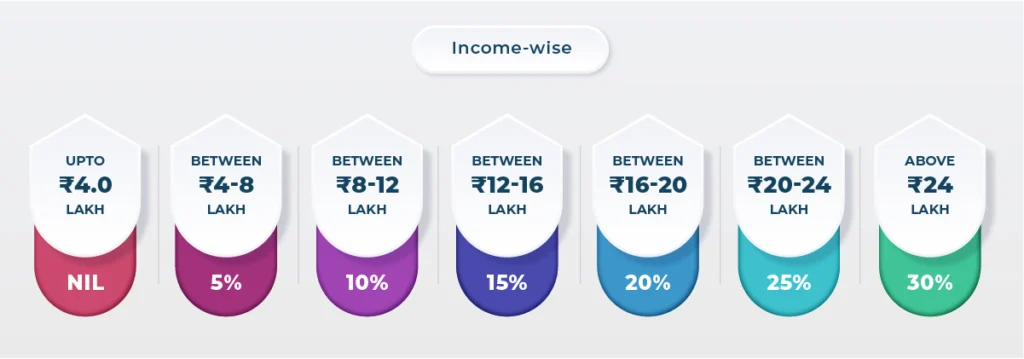

New Tax Regime (FY 2024-25 onwards)

| Income Range | Tax Rate |

|---|---|

| Up to 4,00,000 | Nil |

| 4,00,001 - 8,00,000 | 5% |

| 8,00,001 - 12,00,000 | 10% |

| 12,00,001 - 16,00,000 | 15% |

| 16,00,001 - 20,00,000 | 20% |

| 20,00,001 - 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Documents Required for e-Filing

| Type | Documents |

|---|---|

| General | PAN, Aadhaar, Bank Account Details |

| Salary Income | Salary Slips, Form 16, Rent Receipts |

| Hindu Undivided Family (HUF) | Interest Certificates, Capital Gains Statements, Rental Agreements |

| Tax Paid Info | Form 26AS, TDS Certificates |

| Deductions | Investment Proofs (LIC, PPF, ELSS), Home Loan Statements |

| Foreign Income | Overseas account/property proofs |

How to File ITR Online

- Sign Up/Login to your Income Tax Filing account.

- Select Income Type: Salary, Business, Capital Gains, etc.

- Auto-fetch Data: From IT Department for ease and accuracy.

- Compare Old vs New Regime: Choose the best fit for you.

- Submit & Verify: Complete the filing and e-verify your return.

Important Due Dates (FY 2024-25)

| Category | Deadline |

|---|---|

| Non-Audit Taxpayers | September 15, 2025 |

| Audit Cases (non-TP) | October 31, 2025 |

| Transfer Pricing (TP) Cases | November 30, 2025 |

| Belated/Revised Returns | December 31, 2025 |

Types of ITR Forms

| Form | Who Should Use It |

|---|---|

| ITR-1 | Salaried, one house property, income < Rs. 50L |

| ITR-2 | Individuals with capital gains, multiple properties |

| ITR-3 | Business income or profession |

| ITR-4 | Presumptive taxation scheme |

| ITR-5/6/7 | LLPs, Firms, Companies, Trusts, etc. |

Why Choose Legit Filings for ITR Filing?

- Auto-filled and accurate tax filing

- Compare tax regimes instantly

- Expert help and advisory

- e-Verification assistance

- Budget-friendly plans for all types of taxpayers

- Timely reminders & updates

Filing After the Deadline?

| Type | Section | Deadline |

|---|---|---|

| Belated Return | 139(4) | Dec 31, 2025 |

| Revised Return | 139(5) | Dec 31, 2025 |

| Updated Return | 139(8A) | Up to 4 years from end of AY |

Late filing may incur penalties under Section 234F and interest under Section 234A. Legit Filings helps minimize errors and avoid penalties.

Ready to File? Get Started with Legit Filings

Whether you’re a salaried employee, freelancer, NRI, or a business owner, Legit Filings simplifies the entire ITR e-filing experience—quickly, securely, and affordably. Let our experts and technology handle the complexity while you enjoy peace of mind.

Free Estimation

Request a quote

Click the get a quote button for free quote. Make sure the information you enter during the quote process is accurate, as it will affect the quote.